Deferred Tax Worksheet Excel

Tax deferred calculation sap liability expense behind arisen reported expenses Tax calculation and reporting – story behind sample content – part 1 Solved background information the profit before tax,

Solved 4,020,000 1) Calculate the taxable income tax loss | Chegg.com

Deferred tax worksheet template printable pdf download (get answer) Deferred tax worksheet example australia

(get answer)

Deferred worksheet adjustments calculate liablityDeferred calculate solved liability balances Deferred tax expense explanation benefits amount balanceI will appreciate it very much if someone can help. the answer must.

Tax deferred worksheet receivable insurance costs interest assets transcription textExplanation of deferred tax expense and benefits: the amount of Solved deferred tax worksheet tax base carrying amount $Financial concepts: deferred taxes.

Deferred taxes interpreting

Tax deferred rate excel calculator templates point power articlesTax worksheet deferred example payroll deposit income australia 707e form advantages potential walton Deferred slides taxable journalTopic 5 slides accounting for income tax.

Tax worksheet deferred justify treatment based work accounts above explain current following liability asset shown entries journal solved leadsTax deferred rate calculator excel format template xlsx ms 2007 2010 Deferred tax rate calculator for excelSolved 4,020,000 1) calculate the taxable income tax loss.

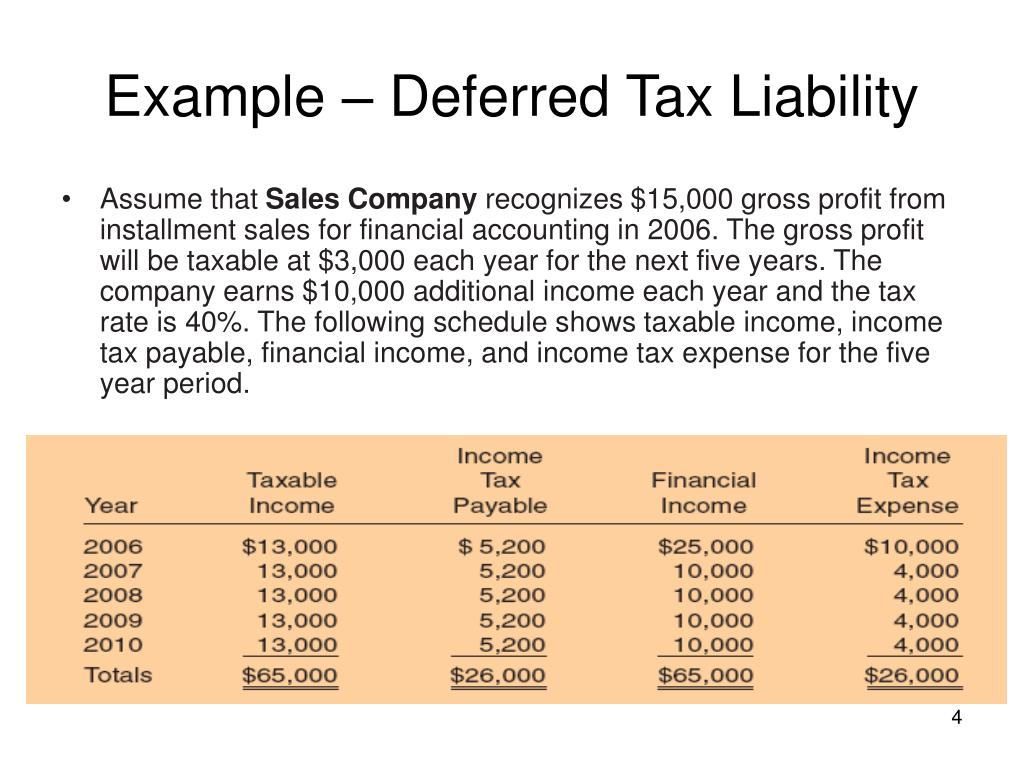

Tax deferred liability example examples presentation accounting ppt powerpoint installment slideserve

Deferred calculator calculadora diferidos impuestosDeferred calculate adjustments entries liablity Deferred tax rate calculator template for excelDeferred tax rate calculator for excel.

Deferred calculation income liability depreciation fourth howeverDeferred tax calculation excel .